Other parts of this series:

Life insurers that invest in artificial intelligence (AI) can improve the customer experience by making it more personalized and data-driven. With AI, carriers can profitably attract and retain customers with new “pay-as-you-live” products and services that reward consumers’ healthy habits. Insurers are increasingly recognizing AI’s promise: global insurance spending on AI platforms will reach $3.4 billion by 2024, growing at a CAGR of 23 percent, according to a report from Insider Intelligence. This trend is a big win for producers and consumers alike because AI enhances the value chain and policy lifecycle at a time when consumers are demanding greater value from insurers.

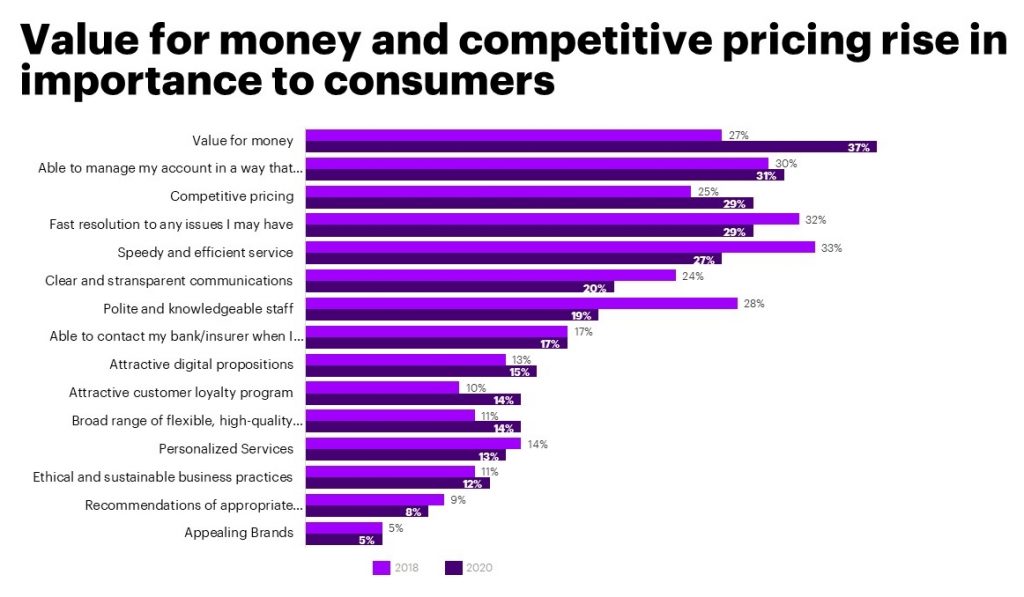

Source: Accenture Global Insurance Consumer Study 2021

Insurers that adopt AI can leverage their data to gain more meaningful and timely insights into their customers. These insights can lead directly to value-added products and processes. For example, intelligent front-end applications that use machine learning can continuously improve customer interactions, whether with humans, chatbots, or both. The goal is to pinpoint and act on opportunities immediately by providing customers and carriers alike with a seamless buying and support experience that leaves everyone satisfied.

Insurtechs have already learned this lesson and have equipped themselves with AI-led digital technologies, leading to effective digital customer experiences. Their digital capabilities highlight the technological shortcomings of legacy insurance administration systems. Insurance companies should view this technology gap as an opportunity to adopt AI-led life insurance underwriting and claims/payout processes to improve their own front-end customer experience while also improving back-office efficiency.

Dynamic underwriting and claims processing models

Often considered a back-office function, underwriting is moving closer to the front office where it has a greater influence on customer experience. This shift became especially apparent during COVID-19 when life insurers used straight-through processing to issue policies using a contactless and completely digital process. In some cases, policies were issued within a few days instead of weeks. These insurers used alternative data from third-party sources, such as electronic health records, combined with machine learning and automation, in lieu of paramedical exams. AI-led underwriting proved to be an ideal process for the direct-to-consumer channel as well and is paving the way for pay-as-you-live life products.

Claims processing presents another opportunity for life insurers to improve both customer experience and operating efficiency. But many insurers are recognizing they may not need to reinvent the wheel, since insurtechs have already done the hard work. Using AI and blockchain technology, insurtechs can offer a completely digital process that’s always on and available to resolve even complex life and annuity claims at scale. These advanced systems are transforming the claims process into an opportunity to retain customers and engage advisors. This is leading many insurers to question whether they could build a better solution themselves, or if they would be better served by establishing partnerships to gain those capabilities.

Guide insurance customers to safety and well-being – Insurance Consumer Study 2021

Learn moreOperationalizing next-level experiences for employees and customers

Through ecosystem partners, insurers can quickly add the capabilities necessary to deliver a seamless, customer-friendly, end-to-end experience for their employees, agents and consumers. While many insurers are digitizing some aspects of the customer experience, the reality is that in order to leapfrog the competition and deliver outcomes at scale, incremental improvements alone are not enough. Fortunately, open, API-driven insurance platforms are enabling insurers to holistically address the customer lifecycle.

These new digital capabilities use vast amounts of data. And whether the data comes from an insurance administration system or a third party, as life insurance operations mature, insurers’ business decisions will require more sophisticated AI and insight-driven predictive modeling across the value chain and policy lifecycle.

This transformation is already underway, with more than 60 percent of insurance companies investing in AI and nearly half planning to accelerate their investments over the next year, according to a GlobalData report. Applying a holistic front-, middle-, and back-end approach to AI, insurers can create a flywheel effect that drives both top-and bottom-line growth and enables innovation at scale. That’s a smart move every insurer should consider.

Let’s talk about your next move, today.

Contact Shay Alon